Boardroom dysfunction warning signs from finance & banking history

WITH fear and anxiety stalking global finance and banking sectors, what are some of the tell-tale warning signs from history of trouble ahead to look out for?

Having researched, described and investigated the roots of all the many and various types of crashes, disasters and scandals that have beset business – globally - during the past 300+ years with leadership expert Professor Randall S. Peterson of London Business School our analysis found – in general terms - that though the dreadful consequences may differ boardroom dysfunctions – including those in the banking and finance industries - nonetheless fall into six easily-identified (often inter-connecting) dysfunctional types.

Arguably, these dysfunctions are even more vital to recognise and/or discover in this time of pending - possibly momentous – financial contagion and upheaval.

Random factors can – obviously - suddenly prompt financial disasters, banking crashes and collapses. However, it isn’t only fast-moving financial contagion or despairing sentiment that turbo-charges these underlying existential threats into catastrophe BUT, our research clearly shows various common dysfunctional boardroom archetypes often drive problematic executive suite psychology, behaviours and cultures.

Either beforehand (or discover at leisure after), what are the psychological warning signs from history to look out for in our financial and banking boardrooms? We found these included:

If crisis management or other rules are required to manage unusual events. Unusual events (financial crashes, banking runs, Covid, etc.) are, by definition, unusual and hard to predict. Whatever specific flavour of disaster, all boards need to improvise in a crisis not follow the newly minted rulebook of the last crash or crisis (aka the “bureaucratic board” dysfunction).

If you have to explain that the culture of your banking or financial company isn’t as iconoclastic/bad/crazy/original/weird as it sounds. Or you have to ‘explain’ your (‘revolutionary’) culture to others, chances are it is as iconoclastic/bad/crazy/original/weird as they fear and anyone making such exculpatory claims has been in it too long to see that (aka the “distended board” dysfunction).

If the charismatic founder or Chair controls everything and brooks no criticism from media, shareholders and executives alike (aka the “bystander board” dysfunction).

If everyone agreed the proposed strategy without reservation (until – of course - with hindsight, it turns out they actually disagreed over it but only in private). After all, reasonable financial and banking people can, and should, disagree (aka the “conforming board” dysfunction).

If only the best directors were appointed on ‘merit’ (aka the “imbalanced board” dysfunction).

When all decisions require CEO sign-off. Boards choose CEOs, not the other way around. (aka the “subordinated board” dysfunction).

Though cast and institutions may vary, their dysfunctions don’t! Worse still, until the actions based on ‘lessons learned’ have more than homeopathic strength, the financial and banking boardroom psychological dysfunctions that helped power the dreadful consequences of the latest (2008) crash look destined to only ever endlessly repeat as tragedy with tragic consequences.

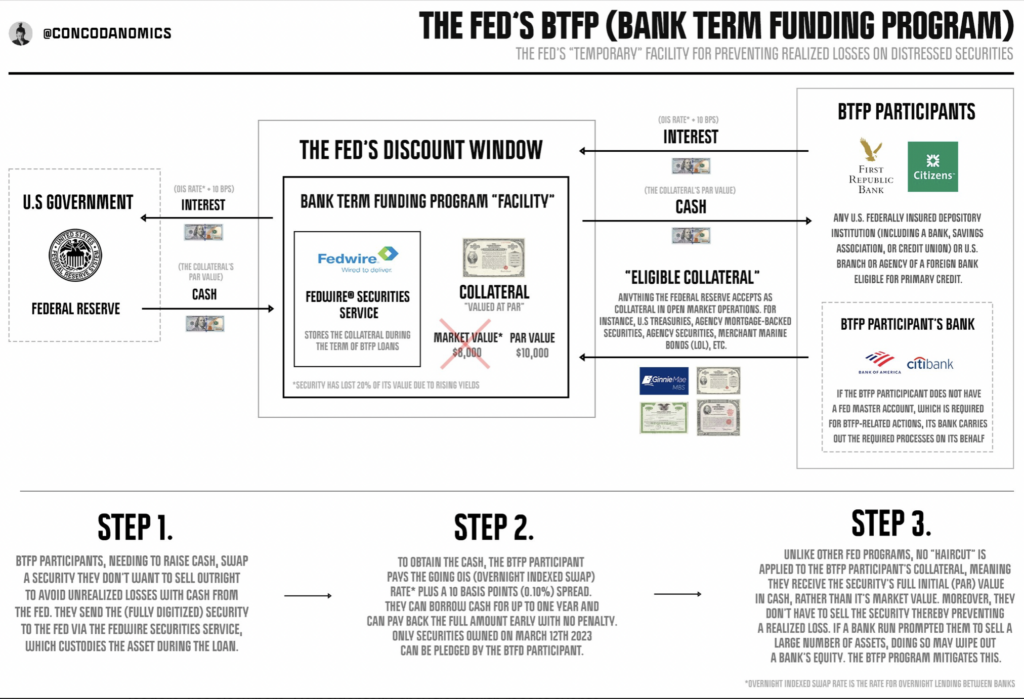

Picture credit: Twitter @concodanomics (newsletter: concoda.substack.com)